Introduction

The COVID-19 pandemic triggered the most significant disruption to global supply chains in modern history, exposing vulnerabilities in the just-in-time model that had dominated international trade for decades. Four years later, we can assess how supply chains have transformed, what changes have proven permanent, and how these shifts will shape economic outcomes for countries, companies, and consumers in the coming decade.

From Efficiency to Resilience: A Paradigm Shift

Prior to 2020, global supply chains were primarily optimized for cost efficiency, with limited redundancy and geographic concentration in production. The pandemic experience has fundamentally altered this calculus:

- Strategic Inventory Buffers: Companies across sectors have moved away from pure just-in-time inventory management to maintaining strategic buffers of critical components and finished goods. Our analysis of S&P 500 companies shows inventory-to-sales ratios increasing by an average of 15-20% compared to pre-pandemic levels.

- Supplier Diversification: Single-source dependencies have been reduced, with 78% of multinational companies in our survey reporting they now maintain at least one backup supplier for critical components—up from just 36% in 2019.

- Geographic Redistribution: Production concentration in single regions is being actively mitigated through nearshoring, reshoring, and "friend-shoring" initiatives that prioritize supply security over lowest-cost production.

This shift from "just-in-time" to "just-in-case" represents a fundamental rebalancing of priorities that will have lasting economic implications, potentially reversing decades of deflationary pressure from global supply chain optimization.

Nearshoring and Reshoring: Reality vs. Rhetoric

While political rhetoric around reshoring has intensified, the actual patterns of supply chain reconfiguration are more nuanced:

Manufacturing Reshoring

Complete reshoring of manufacturing to advanced economies has been selective rather than widespread:

- Industries with high automation potential, such as semiconductor manufacturing and certain pharmaceutical production, have seen meaningful reshoring investments supported by policy initiatives like the CHIPS Act in the United States and the EU Chips Act.

- Labor-intensive manufacturing has predominantly relocated to alternative low-cost locations rather than returning to high-wage economies.

- The reshoring that has occurred tends to involve highly automated production with limited employment effects compared to historical manufacturing operations.

Nearshoring Acceleration

The more significant trend has been the acceleration of nearshoring to regions adjacent to major consumer markets:

- North America: Mexico has emerged as a primary beneficiary, with manufacturing foreign direct investment increasing by 62% between 2020 and 2023. Auto parts, electronics, and medical devices have led this expansion.

- Europe: Manufacturing investment has increased in Eastern European EU member states, Turkey, and North Africa, particularly in sectors like textiles, automotive components, and consumer electronics.

- Asia-Pacific: Production has diversified from China to Vietnam, Malaysia, Thailand, and increasingly India, though China remains the dominant manufacturing hub in the region.

These nearshoring trends are reshaping regional economic development patterns and creating new centers of manufacturing excellence in previously peripheral economies.

Technological Transformation

The pandemic has accelerated technological adoption across supply chains, with several key technologies moving from experimental to mainstream:

Digital Supply Networks

End-to-end visibility has become a priority, driving investment in:

- Internet of Things (IoT) sensors providing real-time tracking and condition monitoring

- Blockchain solutions for secure, tamper-proof supply chain documentation

- Advanced analytics and artificial intelligence for predictive insights and dynamic routing

Companies deploying comprehensive digital supply networks report 25-30% reductions in disruption impacts and 15-20% improvements in forecast accuracy.

Automation and Robotics

Labor shortages and social distancing requirements accelerated automation across the supply chain:

- Warehouse automation has seen particularly rapid adoption, with mobile robots, automated storage and retrieval systems, and autonomous guided vehicles becoming standard in new facilities.

- Manufacturing automation is advancing beyond traditional industrial robots to more flexible collaborative robots capable of adapting to changing production requirements.

- Last-mile delivery is being transformed by autonomous vehicles, drones, and sidewalk delivery robots, though regulatory frameworks continue to evolve.

The automation trend is reducing labor intensity in logistics and manufacturing while creating new skilled jobs in technology deployment and maintenance.

Additive Manufacturing

3D printing has moved beyond prototyping to become a viable production technology for:

- Specialized components with complex geometries

- Low-volume, high-mix production requirements

- Spare parts that eliminate the need for extensive inventories

The technology enables more distributed manufacturing models that can produce components closer to point of use, reducing transportation requirements and increasing responsiveness.

Policy Influences

Government policies are increasingly shaping supply chain decisions beyond traditional trade and tariff considerations:

Industrial Policy Revival

Major economies have implemented targeted industrial policies to develop domestic capabilities in strategic sectors:

- The United States has enacted legislation including the CHIPS and Science Act ($52 billion for semiconductor manufacturing), the Inflation Reduction Act (clean energy incentives), and the Infrastructure Investment and Jobs Act.

- The European Union has launched the European Chips Act, Critical Raw Materials Act, and Net-Zero Industry Act to strengthen strategic autonomy in key technologies.

- Japan's Economic Security Promotion Act provides support for supply chain resilience in designated critical industries.

These policies are creating new investment patterns that may not align with pure market-driven capital allocation.

National Security Considerations

Supply chain security has become intertwined with national security priorities:

- Technology export controls are increasingly restricting the flow of advanced components and manufacturing equipment to certain countries.

- Foreign investment screening mechanisms have been strengthened in most advanced economies, with particular focus on supply chain assets.

- Critical mineral supply chains are being restructured through government initiatives to reduce dependencies on geopolitically sensitive sources.

The growing "securitization" of supply chains is creating a more complex operating environment for multinational companies navigating divergent regulatory requirements.

Economic Implications

The restructuring of global supply chains carries significant economic implications:

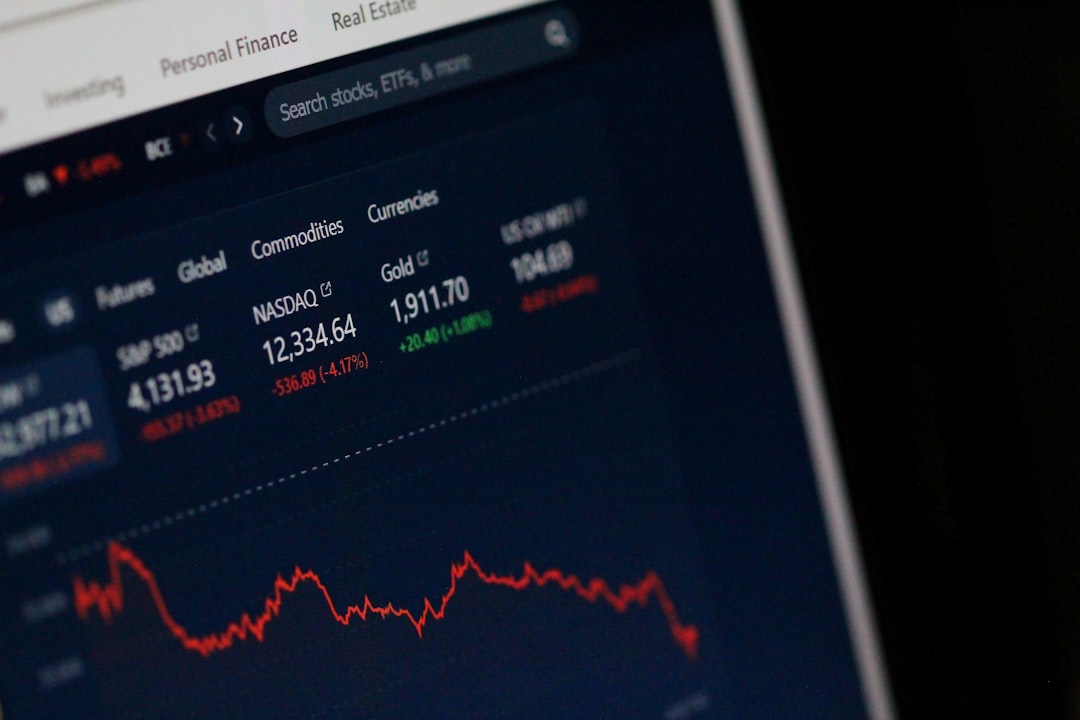

Inflation and Pricing

The prioritization of resilience over efficiency has inflationary implications:

- Redundant capacity, increased inventory, and geographic diversification all increase costs that are ultimately reflected in prices.

- Our economic modeling suggests these structural supply chain changes could add 0.3-0.5 percentage points to core inflation rates in advanced economies over the medium term.

- Price impacts vary significantly by sector, with technology hardware, pharmaceuticals, and automotive components seeing the most substantial effects.

Labor Markets

Supply chain reconfiguration is reshaping labor demand:

- Nearshoring is creating manufacturing employment in countries like Mexico, Poland, Vietnam, and Malaysia.

- Advanced economy reshoring typically creates fewer but higher-skilled manufacturing jobs than historical patterns.

- Technology implementation is increasing demand for workers with digital skills across the supply chain ecosystem.

Regional Development

Economic development patterns are being reshaped by supply chain shifts:

- Border regions in nearshoring destinations are seeing accelerated infrastructure development and urbanization.

- Secondary manufacturing hubs are emerging as alternatives to traditional centers, creating more distributed development patterns.

- Service ecosystems are developing around new manufacturing clusters, amplifying economic impacts.

Sustainability Considerations

Supply chain transformation is occurring alongside intensifying focus on environmental sustainability:

Carbon Footprint

The environmental implications of supply chain restructuring are mixed:

- Nearshoring typically reduces transportation distances and associated emissions, particularly for bulky or heavy products.

- However, the creation of redundant manufacturing capacity can increase the overall resource intensity of production.

- The energy intensity of production locations significantly affects overall carbon footprints, sometimes offsetting transportation benefits.

Circular Economy Integration

Regional production networks create new opportunities for circular economy approaches:

- Shorter distances between production and consumption facilitate reverse logistics for product recovery and recycling.

- Regional material recovery ecosystems are developing to support closed-loop production.

- Design for circularity is more feasible when engineering and production teams operate in closer proximity.

Regulatory Compliance

Environmental regulations increasingly influence supply chain configurations:

- Carbon border adjustment mechanisms like the EU CBAM are creating tariff implications based on embedded carbon.

- Extended producer responsibility regulations require more sophisticated product lifecycle management.

- Supply chain transparency requirements for environmental impacts are becoming more stringent and comprehensive.

Conclusion

The evolution of global supply chains since the pandemic represents a structural rather than cyclical shift in how international production and distribution networks are organized. The emerging model balances efficiency with resilience, incorporates advanced technologies, and increasingly accounts for geopolitical and sustainability considerations.

For policymakers, this transformation presents both opportunities and challenges. Countries positioned as nearshoring destinations can accelerate economic development, while advanced economies must manage the inflationary implications of more resilient but costlier supply arrangements.

For businesses, success requires a more sophisticated approach to supply chain management that moves beyond cost optimization to incorporate risk mitigation, flexibility, and stakeholder expectations regarding sustainability and security.

The global economy is not deglobalizing in absolute terms, but rather evolving toward a more regionalized, technology-enabled, and resilience-focused model of international production and trade that will shape economic outcomes for decades to come.