Introduction

The monetary policy landscape has undergone a significant transformation over the past year, as major central banks navigate the delicate balance between taming inflation and supporting economic growth. This analysis examines how recent policy decisions are reshaping financial markets, investment strategies, and economic trajectories across the globe.

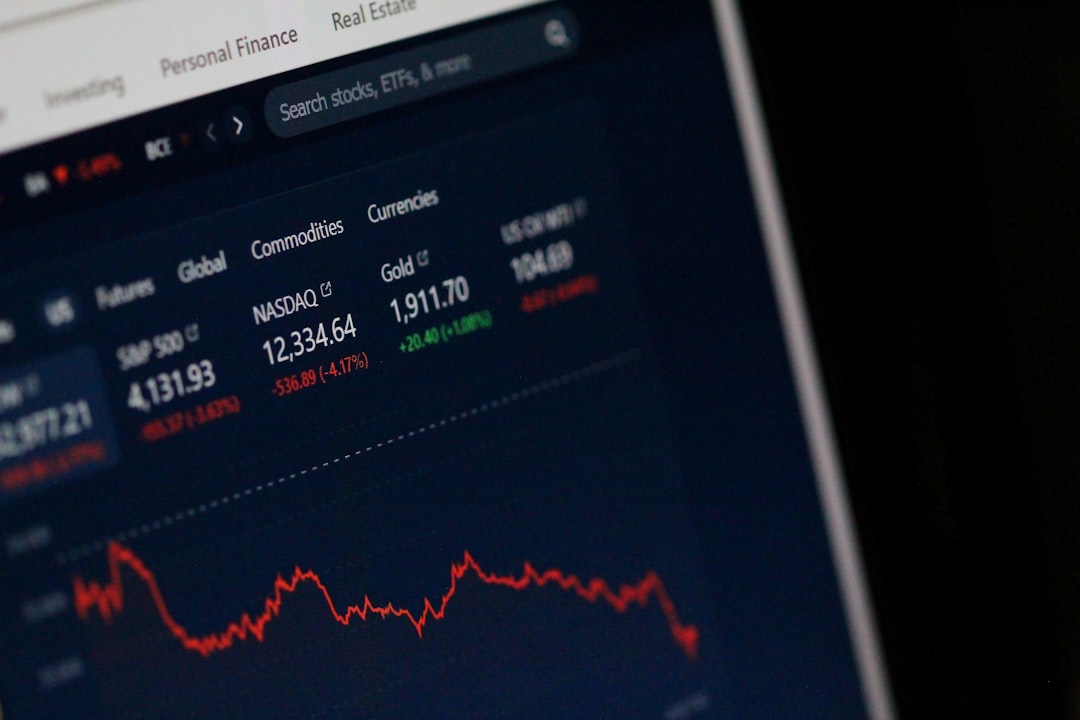

The Federal Reserve's Pivot

After implementing one of the most aggressive tightening cycles in its history, raising rates by 525 basis points between March 2022 and July 2023, the Federal Reserve has now maintained a holding pattern for three consecutive quarters. This pause has significant implications:

- Market expectations have shifted from concerns about additional tightening to anticipation of rate cuts, with futures markets pricing in 2-3 reductions in 2024.

- The Fed's communications strategy has emphasized data-dependency, creating heightened sensitivity to inflation and employment reports.

- The extended higher-rate environment has begun to show uneven impacts across economic sectors, with housing and commercial real estate particularly affected.

The Fed's current stance represents a delicate balancing act—maintaining restrictive policy to ensure inflation's continued moderation while avoiding unnecessary economic damage. Recent statements from FOMC members suggest increasing comfort with the inflation trajectory, potentially opening the door for policy easing later this year.

The European Central Bank's Challenges

The European Central Bank faces a more complex set of circumstances than its American counterpart:

- Economic growth across the Eurozone remains fragile, with several major economies including Germany experiencing periods of contraction.

- Inflation dynamics vary significantly across member states, complicating the implementation of a single monetary policy.

- The ECB has signaled a potential rate cut by mid-2024, potentially moving ahead of the Federal Reserve in beginning its easing cycle.

The divergence between ECB and Fed policy trajectories has implications for currency markets, with the euro/dollar exchange rate likely to be influenced by the relative timing of policy adjustments. This currency dynamic, in turn, affects trade balances, corporate earnings, and investment flows between these major economic blocs.

The Bank of Japan's Normalization Process

After decades of ultra-accommodative monetary policy, the Bank of Japan has begun a cautious normalization process:

- The adjustment to yield curve control in December 2022 and its subsequent abandonment in March 2023 represented significant shifts in policy approach.

- The January 2024 interest rate increase, though modest at 0.1%, marked the first rate hike since 2007 and a symbolic step away from negative interest rate policy.

- Market reactions have been substantial, with increased volatility in the yen and significant adjustments in global bond portfolios.

The BOJ's normalization process is likely to be gradual and cautious, but even incremental changes can have outsized effects after such a prolonged period of extraordinary accommodation. This shift has particular significance for global carry trades and bond market dynamics.

Emerging Market Central Banks

While advanced economy central banks have largely paused or are preparing to ease, the picture in emerging markets is more varied:

- Several Latin American central banks, including Brazil and Mexico, have already begun easing cycles in response to cooling inflation.

- Asian central banks have generally maintained more accommodative stances throughout the global tightening cycle.

- Eastern European monetary authorities continue to navigate high inflation alongside proximity to geopolitical tensions.

The policy divergence between developed and emerging markets creates both challenges and opportunities. Countries with sound fundamentals and credible monetary policies may benefit from capital inflows as investors seek higher yields, while those with external vulnerabilities could face pressure as global liquidity conditions shift.

Market Implications

The evolving central bank policy landscape has profound implications for financial markets:

Fixed Income Markets

Bond markets have already begun to price in rate cuts, with yield curves steepening after a period of inversion. This environment typically benefits longer-duration fixed income assets, though volatility may increase during the transition period. Corporate credit spreads have remained relatively tight, suggesting investors anticipate a soft landing scenario rather than a significant economic downturn.

Equity Markets

Stock markets have responded positively to the prospect of monetary easing, particularly in sectors with higher sensitivity to interest rates such as technology and consumer discretionary. However, market breadth remains a concern, with performance concentrated in a relatively small number of large-cap companies. A more balanced market rally may emerge as rate cuts materialize and economic benefits broaden.

Currency Markets

The relative timing and magnitude of rate adjustments will be a key driver of currency valuations. The anticipated earlier easing by the ECB compared to the Fed could place downward pressure on the euro, while the BOJ's normalization may support the yen after a period of weakness. Emerging market currencies will likely show increased differentiation based on economic fundamentals and policy credibility.

Economic Impact

The broader economic effects of shifting monetary policies will take time to fully manifest:

- Consumer spending patterns may gradually adjust as mortgage refinancing opportunities emerge and debt servicing costs decline.

- Business investment could see a modest boost as borrowing costs decrease and confidence in the economic outlook improves.

- Labor markets, which have shown remarkable resilience during the tightening cycle, may maintain their strength through the transition to easing.

The lag between monetary policy changes and their economic impacts means that central banks must be forward-looking in their decisions, a challenge that increases the risk of policy errors in either direction.

Conclusion

The current transition in global monetary policy represents a pivotal moment for the post-pandemic economic landscape. The shift from tightening to holding to eventual easing by major central banks will reshape financial conditions, asset valuations, and economic trajectories.

For investors, this environment requires careful positioning across asset classes and geographies, with attention to both the opportunities created by policy easing and the risks that emerge during monetary transitions. For policymakers, the challenge remains calibrating the pace and magnitude of adjustments to support economic activity without reigniting inflationary pressures.

As central banks navigate this complex terrain, market volatility is likely to remain elevated, particularly around key data releases and policy announcements. The differentiated timing of easing cycles across regions creates both challenges and opportunities for global portfolio allocation and currency exposure management.